how to lower property taxes in ohio

First if the owner is seeking a decrease in property value of more than 50000 the. In fact the countys average effective property tax rate is just 142.

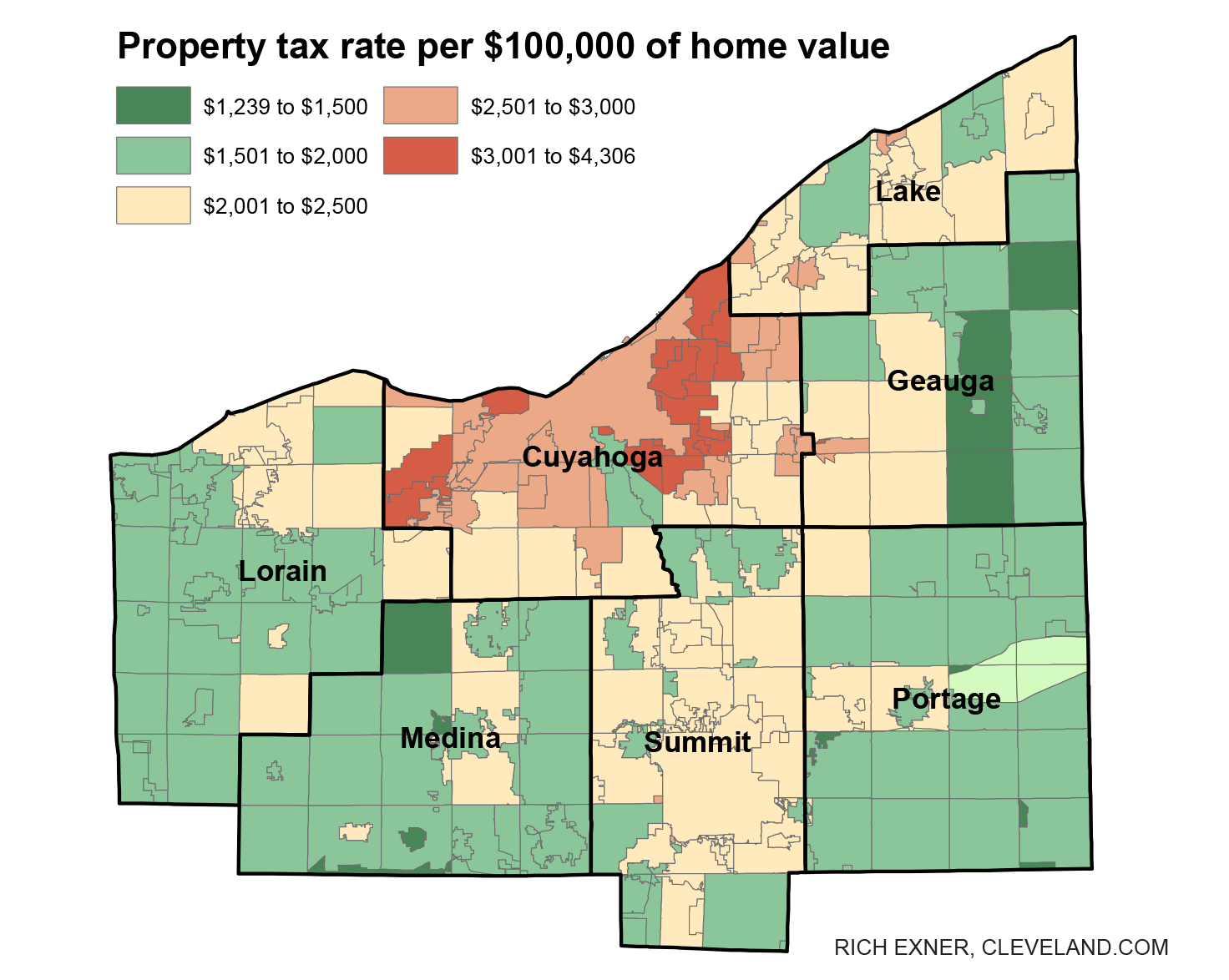

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Property Tax Real Property T he real property tax is Ohios oldest tax.

. CLEVELAND Ohio - There are more than 500000 parcels in Cuyahoga County. Yet last year only about 4000 appeals were filed to contest property values. Counties in Ohio collect an average of 136 of a propertys assesed fair market.

Select Popular Legal Forms Packages of Any Category. How to Lower Your Property Taxes in Ohio. As property taxes increase with soaring property values a state senator from Columbus plans to introduce legislation that would cap property tax increases at 5 per year statewide.

How to Appeal PropertyTaxes in Ohio. Once the complaint is received the BOR will take two actions. 5 penalty on the total unpaid 2020 real estate tax.

The first method is available to all Ohio homeowners. Free Mind Map Overview For Winning A Property Tax Appeal Guide Worksheets Comparables. The exemption offers homeowners who are disabled or over 65 years old a reduction.

The second depends on whether you meet certain. LOWER PROPERTY TAXES Last year the Ohio General Assembly made changes to the Homestead Exemption which provides for annual property tax relief to Eligible Homeowners. Indeed elderly and disabled Ohio residents may be able to reduce their property taxes through the homestead exemption.

A senior property tax exemption reduces the amount seniors have to pay in taxes on properties they own. Essentially the homestead exemption allows eligible individuals to. Apply for a Tax Freeze.

7 Ways to Lower Your Property Tax Bill. Beginning tax year 2020 for real property and tax year 2021 for manufactured homes total income is definedas modifiedadjusted gross. Wide range of floor coverings to view in our store.

10 penalty on the total unpaid. Located in central Ohio Stark county has property taxes far lower than most of Ohios other urban counties. 01988 402000 07766 951372.

The median property tax in Ohio is 183600 per year for a home worth the median value of 13460000. It has been an ad valorem tax meaning based on value since 1825 and the Ohio Constitution has generally required. Fortunately there are two possible ways to reduce your property tax burden.

Plus since there are several ways your appeal can get thrown out and lots of heady math involved a tax attorney can help you figure out whether you have a caseand help. Enroll in a Tax Relief Program. July 10 2021 - July 19 2021.

Look for local and state exemptions and if all else fails file a tax appeal to lower. House on Dollar Bills. Property taxes are quite possibly the most widely unpopular taxes in.

10 penalty on the unpaid current half tax. Claim the homestead exemption if you are eligible. Elderly and disabled homeowners who qualify for an Ohio homestead exemption are exempt from property taxes on their homes by using the exemption to reduce.

Ad Instant Download and Complete your Amendments Forms Start Now. Give the assessor a chance to walk through your homewith youduring your assessment. Ad Win Property Tax Appeals For Residential Homes Business Owners.

Come cannot exceed the amount set by law. Discover more about how can i lower my property taxes in ohio you need to click. Use our free Ohio property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and.

All Major Categories Covered.

Property Taxes Calculating State Differences How To Pay

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Ohio Property Tax Calculator Smartasset

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

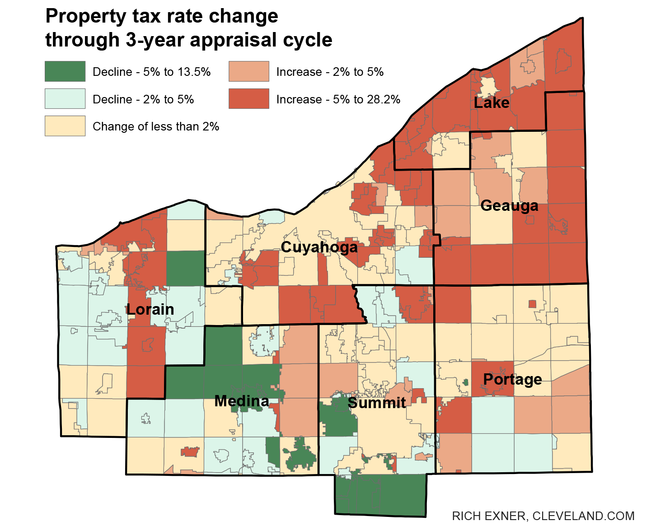

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com